Keep It Simple

Why is it so complicated?

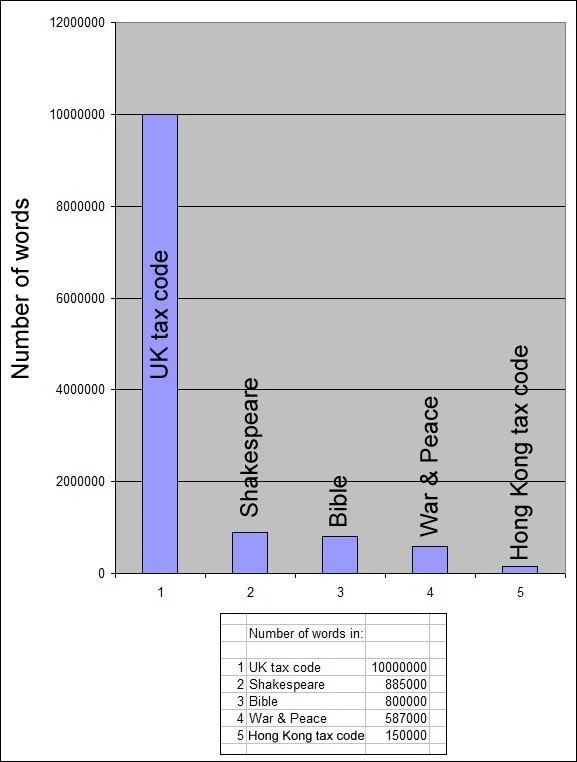

UK tax law ("the tax code") contains over 10,000,000 words making it 12 times the size of the complete works of Shakespeare and 12.5 times the size of the Bible.

The Hong Kong tax code is considered to be one of the simplest and most straightforward in the world - it has fewer than 150,000 words.

Why is this?

Four reasons:

It has been developed and added to over a long period of time. Every government has added to it while taking nothing away - despite what they say about "reducing red tape" and "making things simpler",

It confuses spending with taxation - see below.

Much of it was written to protect the interests of property and wealth.

It is written by lawyers. Exceptions in complex law mean tax avoidance lawyers laugh all the way to the bank.

We need national taxes

Government spends on our behalf: health, education, infrastructure, welfare, security etc.

Government raises taxes from us.

Taxes, like income tax and VAT, take money out of people’s pockets - they reduce spending power.

This is another reason why we should reduce taxes on income earned from work and increase taxes on unearned income. (See our comments on tax reform.)

Tax also has the effect of taking money out of the economy to prevent inflation - or we would end up with hyperinflation like the Weimar Republic!

One way or another, taxes are required - so they should be simple to understand, fair and impossible to avoid., That’s exactly what Land Value Tax is.

We could do it by saying:

"well, we each benefit in the same way from government spending so we should each pay the same amount."

The person cleaning the lawyer's office should pay the same as the lawyer. Someone holding 250,000 acres of land and four country houses should pay the same as a nurse renting a high rise flat.

This has been tried - and the result is always the same - from The Great Revolt of 1381 to the Poll Tax Revolt of 1991.

Tax should be proportional.

The proportion of tax paid by the cleaner should be the same as that paid by the lawyer or the landholder.

We don’t need local taxes

As citizens we have every right to expect the same services, and the same standard of services, no matter where we are in the country.

This cannot be done with local taxes - like Council Tax.

Different Local authorities have different demands on their services. A rural LA, like Derbyshire or Shropshire, has a lot more roads and lanes to look after, and has to spend more on bin collection, than a compact LA like Westminster. An area with considerable social deprivation, like Middlesborough or Stoke on Trent, has much greater demands on its services than an area like The Royal Borough of Kensington and Chelsea.

Local taxes are a left-over from the Poor Laws which go as far back as 1536. Poor Laws put the responsibility for looking after the poor onto the local parish and remained in place until the arrival of workhouses and eventually the welfare state.

Anyone interested in the history of workhouses should visit workhouses.org.uk. For example, there is a (very long!) list of St Pancras inmates from the 1861 census.

The idea that local people should pay for all the services and problems of a local area is still with us - as Council Tax.

In 2010 Council Tax covered about 36% of LA expenditure, by 2024 it had risen to over 56% as national government refused to raise national taxes and pushed more and more costs onto Local Authorities - resulting in a collapse of LA spending by over 40% in real terms.

In the second decade of the 21st century we still have London boroughs sending their homeless to Stoke on Trent to reduce the cost of housing them - despite the fact that Stoke has a crisis of poverty.

All our services, national and local, should be funded nationally - by government.

We need national funding and local delivery because LAs are best placed to deliver local services - they know their area.

Government can sit down and agree what local services have to be provided. LAs can then provide details of what those services will cost. Government then covers the cost.

Land Value Tax is a general purpose national tax, spread fairly across the country, and can easily raise the equivalent of what LAs require to provide us with the services we need.

Confusing spending with taxation

The biggest problem is that governments fail to separate spending from tax.

We don’t have a hypothecated tax system in the UK - we don’t raise this tax to pay for that thing. Muddling the two, by using thousands of tax breaks, is why we have the longest tax code in the world and why British tax lawyers make such a good living.

Tony Blair and Gordon Brown were sincere in wanting to do good, they wanted to improve the lives of "ordinary people". They made two mistakes. They trusted the system (The City, financial institutions, multi-national businesses, the social hierarchy, etc.) and they tried to use the tax system to solve society's problems.

The result was the largest ever increase in the size of the tax code - which made tax avoidance lawyers very happy! Some good was done on the way but the end result was failure - our distribution of wealth is now at the worst ever - and we are still picking up the mess created by PPP/PFI.

They failed because they looked at the end of the process, taking tax out, instead of at the start, government spending.

The moment you hand out "tax breaks" (a reduction in tax) in an attempt to solve problems, you are confusing spending with taxation.

Everything done with a tax break (including benefits) can be done by government spending. If you want to support people financially (which is what tax breaks are supposed to do) then do it with spending.

This is simple to do and would cut the size of the tax code by about 95%!

It all balances out in the end because government spending is balanced by what it takes as tax.

It ain't rocket science - but it would lead to very unhappy lawyers!

What about Land Value Tax?

Most of us recognise that the most significant problems we have in society are the result of our unfair distribution of wealth - the worst in Europe (* see below for symptoms.)

If we want to do something about this we have to recognise the obvious - you can't redistribute wealth without redistributing wealth!

People get confused about what Land Value Tax is and what it is supposed to do.

LVT is a general purpose tax - it is a charge on the market value of all land.

Like all taxes, LVT takes money out of the economy.

LVT is fair - those with the most valuable land pay the highest LVT.

LVT can be used to replace unfair taxes where those less well off pay a higher proportion of their income than those better off.

* symptoms of the problem:

Alienation, lack of trust in the system, lack of trust in politicians.

Low voter turnout. The 2024 election had the lowest turnout in history (under 60%) except for 2001 under Tony Blair. In the German elections of February 2025, 80% of the electorate turned out.

Only 1 in 5 of the electorate voted Labour. 80% of us did not vote for the current government!

The swing towards right wing "populism". In 2024 34% of votes went to Labour, 38% went to the Conservative and Reform.

Falling standard of living leading to increases in petty crime - particularly shoplifting.

It is important to recognise that LVT can't fix everything - but it is a good start towards creating a fairer and more prosperous society.

Why not tax wealth?

We have covered this is a separate article on wealth taxes.

They have failed everywhere they have been tried.

Wealth taxes are complicated, they encourage avoidance or even criminality.

They are almost impossible to enforce. It would need tens of thousands of additional staff at HMRC knocking on doors. “The Under The Bed Squad!”

They can run - but they can’t hide!

The wealthy don’t like paying taxes - they use every trick in the book to avoid it.

If all else fails, they leave - with all their wealth - except land!

It’s a free country, no one will stop them. They are free to settle their affairs with HMRC, surrender their passports, give up their UK citizenship and become citizens of any country that will have them.

However, they will still be liable for LVT on any land they hold in the UK - they can’t take that with them! If they remain UK citizens they will also pay LVT on any land they hold outside the UK.

An indirect tax, like Land Value Tax, is easy to understand, easy to implement and requires no policing because it is impossible to avoid - you can’t hide land in a tax haven and we know who the freeholder is, wherever they are!

What about those who will pay more?

A few things to be clear about:

No one will have to move home because of LVT.

Over 80% of us will pay less in LVT than we pay in Council Tax. Some of us will pay up to 10% more. A very small number of us will pay over 10% more.

There will be no exceptions to LVT, not anywhere and not for anyone. Exceptions are unfair and they create the loopholes that enable tax avoidance lawyers to laugh all the way to the bank.

In the long run, we, as a society, will gain from the introduction of LVT. It spreads the cost of the services we all need fairly across the country.. Over time it will bring down the price of land and make homes more affordable. Over time it will redistribute economic development fairly across the country and have a dramatic impact on the North-South divide.

The single biggest obstacle to implementing LVT is political. Politicians are afraid of the impact it will have on those whose land and property is worth most - particularly in London and the South East.

You can't have it both ways! You can't tackle the fundamental problem that leads to mistrust of our political system - the unfair distribution of wealth - without changing the distribution of wealth!

Politicians are the only ones who can lead - they need the courage of their convictions!

There are four straightforward ways to mitigate the impact of LVT.

Limit the taxes replaced by LVT to keep the LVT rate low. Start with Council Tax alone.

Phase introduction over 10 years. Council Tax gradually goes down, LVT gradually goes up. This allows plenty of time for people and the market to adjust.

Provide an option for those who cannot afford any increase over Council Tax to defer payment of the balance until property is sold or transferred.

Use supplements - see below.

The answer lies in supplements

The basic LVT rate is simple enough to be calculated by a year 6 pupil:

LVT percentage rate = Amount Required / Total land value * 100.

This basic LVT rate applies to all land in the country with no exceptions so there are no "LVT breaks" or "special cases".

Supplements are additions to the basic rate. For example, a 200% supplement would triple the rate.

The more that can be raised by national supplements, the lower the basic rate. Please contact us for a simple spreadsheet that makes this clear.

The choice of which supplements to use is political but here are few suggestions:

National level:

Freeholder not resident in the UK for tax purposes.

Freeholder not a natural person (e.g. a company or trust).

Freeholder not a UK citizen.

Freehold held in a tax haven.

Local level:

Dwellings that are not a primary residence.

Holiday homes.

Holiday lets.

Airbnbs.

Property not occupied for more than six months of the year in total.

Property where activities cause environmental damage.

A local supplement could also be used to fund a specific project - with the agreement of the local electorate.

What about London and the South East?

Note: we use "London" below to refer to London and the South East.

The four methods of mitigation (above) should be sufficient to smooth the introduction of LVT - even in London.

London must have the same basic LVT rate as everywhere else - that's fair. To do otherwise would destroy the elegant simplicity of LVT and lead to riots in Barnsley!

We cannot allow exceptions for Londoners - or the lawyers will be laughing again!

Those in London may not feel "wealthy" but, in terms of their average salaries and the value of their property, they are much wealthier than the rest of the country - this means they will pay more. This is what the redistribution of wealth, and the ending of the North-South divide, means.

In reality, this means many "ordinary" Londoners will be paying more (in most cases, not much more) than "ordinary" people outside London.

However, politicians may decide that this increase is still too much for "ordinary" Londoners.

The solution is straightforward.

London can implement additional local supplements on land held by those who can afford to pay - whoever they are - financial institutions, houses above a certain value, oligarchs, media moguls - whatever. The choice is wide and it is entirely up to Londoners and their local politicians.

The more that is raised with these local supplements, the lower the basic LVT rate will be for everyone else in London.

London has a solution - if it needs to use it.

Very important note

Everything discussed above is based on informed estimates because:

We don't know the total amount that LVT has to raise.

We don't know the total value of all land in the country.

This is why we are promoting "Preparing for LVT - getting the facts."

Politicians, and the rest of us, need facts before decisions can be made - and we can get those facts now, without waiting for the next election or change of government!