How tax really works

Warning: this page may change the way you understand the world! (Sorry, it’s a bit long - we have added a few AI generated images to lighten the tone!)

The UK doesn’t operate a hypothecated taxation system - taxes are not raised and allocated to specific spending.

Vehicle Excise Duty (popularly known as “Road Tax”) doesn’t fund roads,

National Insurance (NI) doesn’t fund the NHS, unemployment benefit and old age pensions.

Paying NI (the “stamp”) provides an entitlement to these things but they are paid for out of general government spending.

Good tax law clearly separates how government spends from how it raises taxes.

Confusing the two, by creating exceptions, tax breaks and special cases, creates loopholes and adds to the confusion. It also explains why we have the world’s largest tax code - 10,000,000 words - 12 times as many as in the complete works of Shakespeare and 66 times as many as in the Hong Kong tax code!

No wonder Tax Avoidance Lawyers laugh all the way to the bank!

Two ways to think about tax

Politicians, particularly the Chancellor of the Exchequer, are faced with a very important question:

Which comes first, the chicken or the egg?

Problems arise (austerity, cuts in benefits, potholes, etc.) when they get the answer wrong - which they do, over and over again!

Egg first: tax pays for things

This assumes taxes (the eggs) have to be gathered before the government can spend.

Chicken first: tax keeps the economy under control

This assumes the government (the chicken) generates the money required to invest and pay for public services but must then use tax to take money out of the economy to keep it under control.

Whichever way you think:

taxes are necessary,

taxes should be simple. Land Value Tax is very easy to understand.

taxes should be fair - those with most, pay most. Land Value Tax is the fairest of all taxes.

taxes should be impossible to avoid., Land Value Tax is impossible to avoid.

The way governments think about tax determines how fairly they can run our country.

The money factory

In 1954 the Bank Of England built the money factory at Debden in Essex. It then gave a contract to De Le Rue to make money - by printing it.

The Debden factory, still in use and still run by De La Rue, is the only money factory in the UK because only the government can create money.

These days cash is much less used. Government remains the only source of money which it also creates by electronic transfer to banks. Actually, it doesn’t even do that, the Bank of England simply changes entries in electronic ledgers!

Before plastic (“polymer”) notes were introduced in 2020 old notes were collected and burnt. Today old notes end up at your local garden centre - they are converted back into plastic pellets to make flower pots.

Egg first: tax pays for things

This treats the national economy like a household budget and assumes tax has to be gathered before the government can spend.

This is what we are told, every day, ad nauseam, by government, the Chancellor of the Exchequer, the tabloid press and most politicians.

They tell us this because:

it is what they were taught when they were at school and university,

it has been the main stream economic thought since Ronald Reagan and Margaret Thatcher,

it serves the interests of those with wealth by not taxing that wealth,

they lack imagination, creativity, understanding and they deny the reality of economic life,

they are blind to alternative ways of seeing.

It assumes the government has a piggy bank topped up by HMRC before it can be spent - like getting your pay packet before you can do the supermarket shopping.

This is the best way to think if you want:

living standards to fall (as they have),

public services to collapse (as they have),

a continuous policy of austerity (as we have),

those with wealth to have an even greater share of our national wealth (as they now do),

those with the least to pay an even greater share of taxes (as they do),

the growth in popularity of people like Donald Trump and Nigel Farage using divide-and-rule politics and scapegoat blaming. (In 2024 Conservatives plus Reform took 38% of the vote, Labour took 34%.)

This way of thinking avoids looking at the fundamental cause of the problem - the fact that we have the most unfair distribution of wealth in Europe.

Ignoring the evidence

Continuing to think like this, despite the evidence in front of our eyes, requires a certain refusal to learn from reality.

"Government has no money of its own."

Not true - this assumes the only source of government money is the taxpayer.

The government can create money and it can use savings (though it doesn't need to).

"Government spends taxpayers' money."

Not true - the government spends money it creates. Tax is paid later - using money created by government.

"HS2 is a waste of taxpayers' money."

True - the money should have been spent on much better things - but it isn't taxpayers' money.

"You can only spend what you earn."

Not true - you can borrow it. (You can't print it, only governments can do that.)

Actually, spending only what you earn is a good idea - personal debt is a bad thing and leads to depression and sleepless nights!

"The money I earn pays my taxes."

Yes, a proportion of what you earn is taken as tax. We argue that money earned from work should be taxed much less than unearned income - you should keep more of what you earn. However, money has to come from somewhere before you can be paid and before you can pay tax. The only place money can come from is the government.

"We must get rid of the national debt."

Not true. Why do we have to get rid of it? See below.

Chicken first: tax keeps the economy under control

This assumes that the government is the only source of money and that tax comes at the end of the process, not at the start.

Where does the money come from?

Individuals and companies can't create money - they will go to jail if they try.

Local Authorities can't create money - which is why they need money from government.

Banks and other financial institutions can’t create money - as they discovered when their reckless gambling crashed the world’s economy in 2007/2008.

Government is the only thing that can create money, either by printing it or by electronic transfer.

After the 2007/2008 crash, the Chancellor, Alistair Darling, didn’t put taxes up then wait for the money to roll in - he saved the banks (and us!) by creating money - starting at £75 billion in 2009 and reaching £375 billion by 2012.

£375 billion is £11,000 for every working person (34 million of them) in the UK!

He did it by telling the Bank of England to create money and pass it to the banks to restore faith in the system. This was done electronically, not as banknotes!

Unlike our current Chancellor of the Exchequer, Alistair Darling understood that:

he was in charge,

he could tell the Bank of England what to do,

he could solve the problem by creating money,

it was his job to take the lead and get on with it!.

Notes:

Governments must shoulder a large part of the blame for the financial crash. City gamblers could be reckless only because governments deregulated the financial market.

Government has learnt nothing - they still want to deregulate the City!

Government fails to understand that the only motivation in financial markets is personal and corporate greed - they get away with whatever they can get away with - so tough regulation is essential.

Back to the chicken and the egg

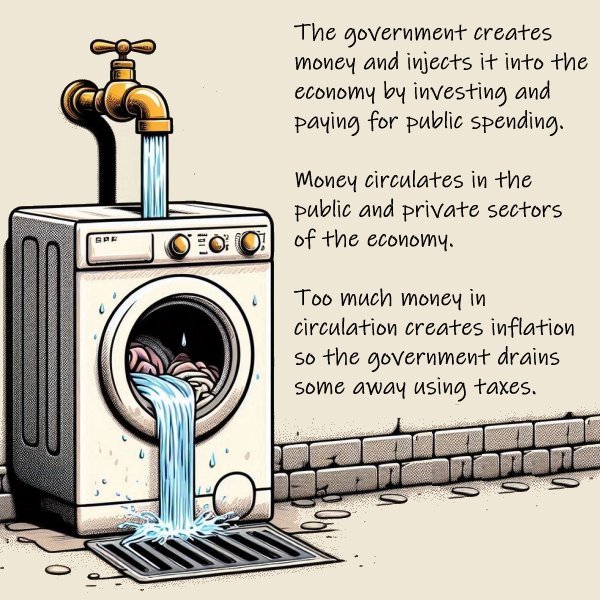

Government spends and invests in things we need as a society: schools, hospitals, infrastructure, security, pensions, benefits etc.

This creates a large public sector and lots of jobs., It also creates a very large and active private sector - companies contracted by the public sector or who sell products to the public sector.

Thought

Can you name half a dozen medium to large private companies (excluding privatised companies because they used to be public and still provide a public service) that are not, directly or indirectly, reliant on public sector contracts or sales to public bodies?

It is obvious for companies who provide medical supplies or weapons but even companies like Stallantis (Peugeot) in Ellesmere Port and Luton rely on Royal Mail (privatised) for sales of electric vans!

Government spending and investment is the start of the economic process, tax comes at the end.

There is a parallel in business: investment comes before income.

Some of us run manufacturing companies and we have to pay for research, development, people, equipment, manufacturing and marketing before we can take the customer’s money! It would be nice to take the customer’s money first (to pay for the research, development etc.) - but it doesn’t work that way - unfortunately!

Government pays for things we need: the NHS, nuclear weapons, education, Porton Down, roads, Storm Shadow missiles, pensions, secret service, welfare, tanks, the Civil Service, etc.

Money circulates. Nurses and missile makers go to Tesco for groceries. Tesco buys food from farmers. Self employed plumbers buy new vans made in Luton. Van makers and farmers buy TVs from Argos. Argos buys stuff from China.

Too much money in circulation causes inflation.

Tax drains away money to keep the economy under control.

It doesn't matter which taxes are used as long as the excess money is drained away.

Some taxes help prevent social and health problems: alcohol, tobacco, gambling etc.

Things become messy when government goes beyond this and tries to use taxes as punishment to change our behaviour. Far better to use the carrot of spending than the stick of tax!

Taxes are required so:

It seems wrong when government chooses not to make our society fairer for all.

It seems unfair that we tax work (earned income) far more than we tax unearned income.

It seems unfair that the less well off pay a higher proportion of their income on tax than those better off.

It seems unfair that those with expensive lawyers can use loopholes to avoid paying tax.

it seems fair that we should use taxes that are simple, fair and impossible to avoid - like LVT!

We have written an article about fairness, equality and silver spoons.

When you get it wrong

This is what happens when you fail to understand how tax works and when you fail those who elected you. This is the “slices of a cake” nonsense that says “if we make more bombs we must cut benefits.”

Does the government 'borrow' money?

Sort of, in a way - but it doesn’t need to! The government certainly provides a home for savings!

Saving with banks and building societies

When we hand over our money to Captain Mainwaring at the bank, or we put our savings into a bond with a building society, do we think of them “borrowing” it?

No, we think of them storing it securely (we hope!) and paying us a little bit of interest on it.

Most of us don’t look too closely at what the banks do with our money while they have it - though some people prefer to save with an “ethical bank” like the Coop.

Banks and Building Societies can go broke - and they have: Northern Rock, Derbyshire B.S. etc.

Saving with the government

The government operates in the same way. It accepts savings from individuals, companies or other countries and guarantees to pay them back, with interest, after an agreed number of years.

One big advantage of saving with the government is that 100% of your money is guaranteed to be returned - unlike the £85,000 limit with banks and building societies.

The author of this page moved some savings from building societies into National Savings a few years ago because the government was paying a good rate of interest on two year bonds. In fact, the rate was so good that millions of people wanted to save with the government - the bond was “oversubscribed” and withdrawn from the market after only a few weeks!

Unlike banks and building societies, the government can’t go broke.

Should we repay the “national debt”?

The “National Debt” is the total amount people, companies and foreign governments have saved with the UK government - and it includes my National Savings bonds! It is the equivalent to the total amount saved in a bank.

There would be chaos if a bank was forced to repay all the money it held - in fact it would lead to a bank run and the collapse of the bank - exactly what happened to the Royal Bank of Scotland and Northern Rock in 2008 when they had to be rescued by the government!

Do we want the debt repaid?

No thank you! I want my National Savings bonds held securely because I lost faith in banks in 2007/2008.

Financial institutions, the City and foreign governments would be in deep trouble if the UK government decided to stop taking deposits - they rely on it to make the system run smoothly.

Besides which, a lot of these savings are long-term: 10, 20 or even 30 years - so they don’t need repaying yet. In fact, many of them are simply rolled over for another 10, 20 or 30 years.

The UK government itself did this when it nationalised the coal mines in 1947. It had no cash after WW II because the “aid” sent by the USA was not given for free - it had to be paid off and the last payment was in 2006! So, the government issued 30 year bonds to pay the mine shareholders the full market price - which was pretty low because the mines had been badly managed - like some privatised water utilities today. When those bonds became due, they were rolled over for another 30 years. The result was that nationalising the mines cost taxpayers nothing - except for the interest that had to be paid on the bonds.

Other ways to control inflation

The government and the Bank of England seem to think that the primary way to reduce inflation is to increase the interest rate and keep it high. This is great for bankers and others who live off interest - however it is very bad for the economy - industry and productive businesses need capital but high interest rates deter investment. There is no reason why the interest rate should ever be higher than the inflation rate and government has a far more powerful way to control inflation - tax!

Any government wanting to invest in the economy, improve local services, raise living standards and create a fairer society must find ways to prevent inflation by draining excessive money from the economy through taxation. LVT can help by replacing any combination of our existing taxes - the initial proposal is that it should replace Council Tax and Business Rates so the government can fully fund all local government services.

LVT shifts tax to those who can best afford to pay it - which must be a fair thing!

There are other straightforward changes to our taxation system that can help with this. The Taxing Wealth Report 2024 outlines reforms that could generate almost £197 billion - which is roughly the same as raised through VAT and more than is raised through National Insurance - so there was no need for Rachel Reeves to increase National Insurance rates! The report is well worth reading.

Despite its name, the report does not suggest a wealth tax - for all the reasons we cover in one of our articles - wealth taxes are populist and sound good but they simply don’t work.

Government choices

Government chooses where to inject money and how to take out taxes.

A government supported by those unwilling to pay tax:

will refuse to inject money into the economy - so it doesn't have to take it out at the other end. This is "austerity".

will ensure that any money injected goes to businesses run by its supporters.

Money for health will be diverted from the NHS to private companies, money for infrastructure will go to wasteful and pointless projects for construction and equipment companies.

will select taxes that impact least on its supporters.

It is a political choice:

to leave 4.3 million children in poverty,

to find it acceptable that the country needs over 2,800 food banks,

to tax work (earned income) far more than taxing unearned income.

to permit UK citizens to use tax havens to avoid tax.

not to tax the value of our most important national asset - land,

not to fully fund Local Authorities,

to maintain a society with the most unfair distribution of wealth in Europe,

to leave our most important national infrastructure in private hands,

not to build more sewerage treatment plants,

to pay for missiles to fight other country's wars,

for politicians and political parties to accept money from individuals, companies and foreign countries operating in their own self-interest.

More information about tax

Try these videos: