Advantages / disadvantages

It’s also worth checking our article on wealth taxes which explain why LVT is best.

Advantages summary

Fairness - those with the most, contribute most.

Easy to understand - the same percentage nationwide.

Natural justice - society benefits from the use of the land it owns and controls.

Impossible to avoid - we can see land and we know the freeholder.

Inexpensive - low cost of collection, few appeals, less work for tax lawyers.

Can be used to replace any existing taxes.

Paid by freeholders, not tenants - no more searching for “the occupier”.

Uses existing resources:

Valuation by the Valuation Office Agency (VOA).

Freehold and valuation records maintained by the Land Registry (HMLR)

Collection by HMRC instead of by over 300 Local Authorities (LAs).

Frees up LA resources for other tasks - planning and holding developers to account.

Transparent - open data via online cadastral maps and Land Registry records.

Encourages land to be used rather than left idle.

Encourages use of brownfield sites and empty sites in towns/cities.

Captures increases in value at all stages. E.g. from fields to housing estates.

Discourages land banking because developers will be paying higher rates of LVT.

Provides compensation by falling in areas blighted by development: noise, smells, etc.

Reduces the North/South divide as business goes to where costs are lowest.

Dampens increases in land value.

Encourages those living off rent to take an active part in land use or to sell up.

Increases land available for those starting out in farming.

Phased introduction to allow people, and the market, to adjust.

Optional deferment for those who cannot afford any increase over existing taxes.

Disadvantages summary

All of the claimed disadvantages are covered by our FAQ and objections articles. We include a small number here.

A very small minority will pay more with LVT than with other taxes.

Phased introduction and deferment will solve this.

Landholders will try to pass on the LVT to tenants.

Tenants are already paying Council Tax so they can cover part or all of this.

The market will then decide.

It will lead to the break-up of large estates - the core of our countryside.

It provides choice: landlords can try to pass it on, work the land themselves or sell.

It will encourage some landlords to sell - reducing houses and land for rent.

Every house sold will be another house on the market for someone to buy.

We need a large expansion in the number of social homes for rent.

Every acre sold is an acre for a working farmer to purchase.

It will destroy farming and increase food prices.

This confuses tax with spending. Farming is a business like any other business.

Farmers require a subsidy to grow food and to look after our countryside.

That is a spending decision, not a taxation decision.

More detail

LVT is fair - those with most pay most.

Norway has a very high level of trust in government, the fairest distribution of wealth in Europe, an excellent free health service with very few people using private health or social care, an excellent free education system with very few people using private schools and a sovereign wealth fund which has invested the income from its natural resources: oil, gas and hydro-electricity. Norway does things for the benefit of all its citizens.

The UK has a low level of trust in government the most unfair distribution of wealth in Europe and we come 20th out of the top 20 countries for happiness.

Alienation is the biggest problem in our society - people feel there is "one law for them, another for us" and they see politicians taking financial donations and freebies. They feel ignored and they are sure that politicians don't understand them.

It is worth asking: why do political parties and MPs need donations? Why are wealthy people like Elon Musk and Nick Candy allowed to influence our politics? Why do we allow people who are not UK citizens, who don’t live here and who don’t pay tax here, to tell us how to run our country by owning our media? Why do we allow foreign governments to directly fund politicians, their staff and their “special interest” groups?

Money buys power in our corrupt and undemocratic political system and the resulting alienation leads to anger which makes it easy for Nigel Farage to offer an easy way out by blaming scapegoats. Ultimately this leads to riots on the streets and a very unhappy society!

"Liberals" (well meaning but sometimes naive people) find it hard to understand why people turn to populism. The answer is in front of their eyes: people can see “the system” for what it is - unfair and failing to act in their best interest. Solving that unfairness requires radical change to the distribution of wealth and power in our country - and that frightens liberals, many of whom are comfortably off.

LVT would be a giant step towards a fairer, happier and more economically prosperous society.

LVT is easy to understand.

No one needs a lawyer to understand LVT - it is the same percentage on the value of land everywhere.

LVT has no exceptions and is impossible to avoid.

We can see the land and we know who the freeholders are.

Tax Avoidance Advisors can be retrained to do more socially worthwhile jobs.

LVT can replace any taxes.

Initially it is proposed that it replaces Council Tax and Business rates.

LVT will rebalance the housing market.

It acts as a damper on increases in land prices. (See below)

LVT will be higher in areas with high land prices because the value of land is higher in those areas. The price of land will slowly fall if people choose to move away from areas with high LVT.

LVT will help to redistribute economic development.

Business will go where costs are least.

LVT will help to end tax avoidance.

Those with wealth (James Dyson, Jeremy Clarkson) buy land to avoid tax, particularly Inheritance Tax. They then become landlords taking rent from tenant farmers who do the real work. LVT will apply to all land so the landlords, as freeholders, will have to pay.

LVT will discourage tax avoidance while leaving more land to be purchased by real farmers.

LVT will help to end land banking.

Those who hold land banks: developers, supermarkets and property speculators; will be paying high levels of LVT - thus encouraging them to get on with the development.

LVT tracks changes in value.

"Hope" land (land with the hope of future development) has a higher value and will pay higher LVT.

Land with an option to purchase by a developer (options will be recorded by the Land Registry) will increase in value and pay higher LVT.

Land with outline planning permission will increase in value and pay higher LVT.

Land with full planning permission will increase in value and pay higher LVT.

LVT encourages economically productive use of land.

It makes sense to use land rather than leaving it idle if you have to may LVT on it.

The actual use of land is controlled by the planning process so there is no fear that the park in front of Chatsworth House will be filled with an executive housing estate to pay the LVT - Peregrine Cavendish would never get planning permission!

LVT will free up Local Authority resources

Council Tax and Business Rates are collected by over 300 LAs. LVT will be collected nationally by HMRC.

Resources freed up will enable LAs to increase the staff they have in their planning and building inspection departments to speed up planning applications, level the playing field between LAs and developers and ensure that new homes are built to the best quality standards.

LVT can go down as well as up.

If land value falls the LVT will fall. E.g. if a site becomes subject to noise or other forms of pollution.

LVT simplifies other things.

All our laws and rules relating to land and property have grown like Topsy. Originally they were created and modified by landholders to protect the interests of landholders - we even engaged in wars to protect the interests of landholders! They were able to do this because they wrote the laws.

It is less than 100 years since we all got the vote on equal terms but in that time things have become even more complicated, primarily because we insist on making exceptions for "special cases". Politicians love "special cases" because it appears they are "doing something" - usually as a knee jerk reaction to something in the media.

For example, take the exceptions to Business rates and Council Tax.

"Business rates relief" is determined nationally and is a dog's breakfast. A whole industry has grown up to promote the avoidance of business rates.

"Council Tax Reduction" is determined locally and is a dog's breakfast. Take this example from Amber Valley Borough Council - and there is even more! Cash-strapped LAs look for ways to generate income so there is no consistency in how they deal with exceptions to Council Tax.

LVT throws all that away because there are no exceptions - the freeholder pays the LVT come what may.

LVT is collected nationally (a huge cost saving) and distributed to LAs to cover the full cost of all the services they are required to provide. Freeholders who cannot afford to pay, for whatever reason, can defer payment until either they can pay the debt or the land is sold or transferred. No special, cases, no exceptions.

Increase in house prices

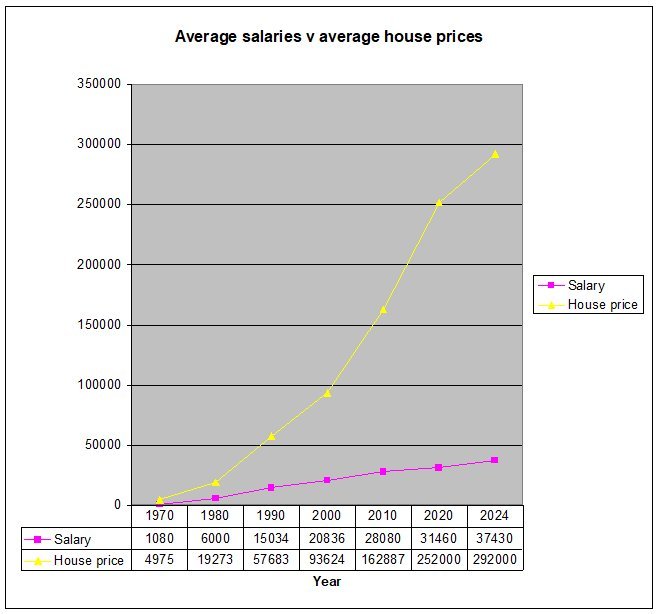

In the 1970s at the age of 23, on an annual salary of £1,400, the author of this page purchased his first home for £4,400 - a decent, detached, Edwardian, three bedroom house in a good area with integral garage and large garden. That would be impossible for a young person in 2024.

In 1980 the ratio of house prices to salaries was 3.2

By 2000 the ratio had risen to 4.5.

By 2020 the ratio had risen to 8.0.

There are insufficient houses to meet demand.

Why has this happened?

There are two possible reasons:

Increases in wages have not kept up with increases in house prices.

We know that wealth held by the 1% has grown astronomically in the last few years while wages have not kept up because of deliberately imposed government austerity.

Short of a revolution there is no chance of wages growing to keep up with house prices.

The cost of building houses has gone up through profiteering.

Bricks, concrete, timber etc. cost more than they did a few years ago. We have a shortage of good trades people (bricklayers, electricians, plumbers, roofers, plasterers, etc. Our one-size-fits-all academically oriented education system is not fit for purpose) - and we have far fewer people from the EU working on building sites. These problems are the same everywhere in the country.

However, the major factor in house prices is the cost of land which varies from one area to another. In 2021 building land in Gateshead was £290,000 per acre while in Sevenoaks it was 12 times more at £3,360,000. Those with land (landholders and developers) sit on it waiting for prices to go through the roof. No tax is paid on this land!

Developers are only interested in profits and by limiting the number of homes they build they can force prices up - and pay huge amounts to their directors and shareholders. Profiteering has been rampant since 2010 - which is why developers continued to be major donors to the Conservative Party during that period.

We cannot rely on developers and big building companies to meet demand. In the past Local Authorities employed their own building work forces but these have been privatised out of existence and we are living with the consequences.

Over time LVT will readjust the price of land across the country.

It comes down to the priority governments put on house building and reducing the cost of land. The Labour Party is already talking about using compulsory purchase at current use value (or at a reasonable multiple of current use value) and allowing Local Authorities to purchase such land to build homes for rent after scrapping "Right To Buy" which has destroyed our social housing stock.

Given the move to the right by the Labour Party, and the economic ignorance of most politicians, many of us believe there will be very little change - apart from tinkering round the edges.

All this means that LVT is required ASAP as a step towards a fairer society.