No exceptions, no loopholes

“There is no law written that I can’t find a way around.”

“The best way to avoid tax is to ensure loopholes are in the original legislation.”

“I love exceptions, I make my living from exceptions.”

As well as being fair, good law should be simple and short – capable of being understood by all of us without having to consult a lawyer.

Good tax law separates tax from spending. Tax should not be used to do favours for one group over another. Everything done with a tax break could be done by spending – and would shrink our tax code by about 95%.

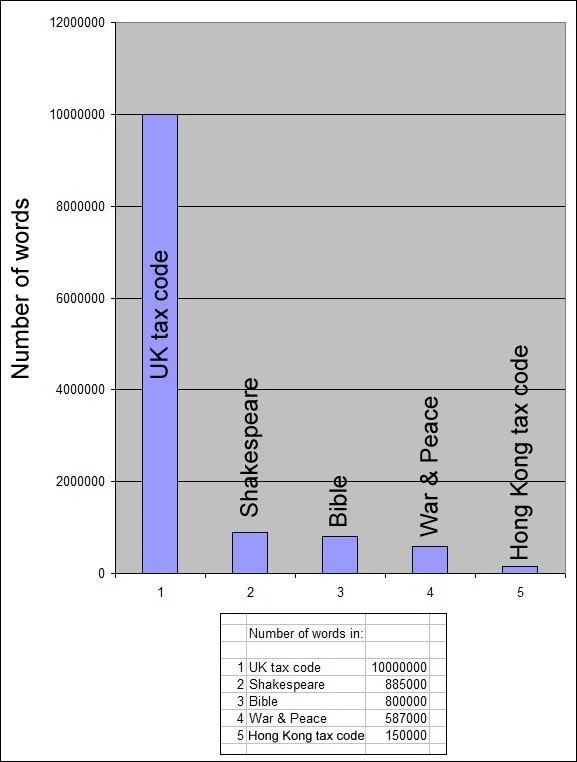

The UK tax code (law) contains over 10 million words making it 12 times the size of the complete works of Shakespeare, 12.5 times the size of the Bible and 66 times the size of the Hong Kong tax code.

The primary reasons for its scale are exceptions, special cases, reliefs and tax breaks – essentially, fiddles.

A whole tax avoidance industry has developed – lawyers and accountants. Their role, along with the media that supports them, is to apply pressure so new legislation contains loopholes and then to make a living by advising their clients on how to use those loopholes to avoid contributing to society by paying their fair share of tax.

Important point

By paying tax you are not buying things - you are contributing to society for the social good.

The idea of tax “buying” things leads to all sorts of selfishness from people whose wealth makes them unpleasant human beings:

“Why should I contribute tax to pay for the education of other people’s children – mine go to private school anyway!”

Why is “no exceptions” so important?

Land Value Tax, as defined on this site, is simply, fair and impossible to avoid.

LVT permits no exceptions, not for anyone and not for anywhere. Land is land no matter what is on it or what it is currently used for – we know where it is, we know who the freeholder is, we know what it is worth - so LVT is due on its value – end of story.

Many politicians, of all parties, want to do the right things to overcome the unfair distribution of wealth in our country. However, they live in fear of those with power and wealth and they are tempted to create legislation that provides special cases, get outs, loopholes, exceptions and tax breaks for those who shout the loudest.

However, you can’t redistribute wealth without redistributing wealth!

In the case of Land Value Tax, those with the most valuable land will pay the most LVT – there is no way round this and we don’t want any way round it!. LVT has far more advantages than disadvantages but it still frightens politicians - even though there are two simple ways to mitigate the impact:

Phasing in over 10 years (other taxes go down, LVT goes up) to allow people and the market to adjust. There will be no sudden changes.

An option to defer any increased payments until property is sold, or transferred. No one will have to move home because of LVT.

Reliefs are loopholes

Council Tax and Business Rates have multiple “reliefs” (loopholes) . Click here for details.

This is not the end of the list! Local Authorities can offer “discretionary relief” - for example when a listed building is empty between owners or tenants. The collapse of LA income means that such reliefs are now few and far between.

Charities can gain up to 80% off their Business Rates and in some cases Local Authorities can add additional “discretionary relief” - meaning no Business Rates are paid at all.

Most charities are seen by most people as a good thing (some are tax fiddles) - a society run in the best interests of all its citizens would require very few charities.

Some properties can be completely exempt from Business Rates - including buildings used for public worship. Click here for more details.

The power of religion

A religious group does not pay Council Tax when one of the properties it holds for “Ministers of religion” is empty. For example, the Church of England does not pay Council Tax if a new vicar has not been appointed and The Vicarage is empty.

Landlords can avoid paying business rates if their property is used by a faith group.

So, if you are a landlord with vacant business premises you can avoid Business Rates if you allow a charitable faith group to use them

Even better, why not set up your own charities and invent your own faith groups? Why not have some of them registered outside the UK to make them even more obscure?

Why not set yourself up in business to advise other landlords on how to avoid tax in the same way by making it appear that their vacant premises are used by faith groups or as “places to pray”?

No way, surely?

Surely no-one would go this far?

Surely this would be a scam?

Surely anyone who did this would be seen by most of us as a crook?

Surely no one would manage to do this?

Mayer Schrieber and Simon Dresdner have been identified in the media with companies that have managed it.

The image above shows Discovery Park in Sandwich. Dover council is pursuing the Park for £1m, challenging a claim that 60 units onsite are faith rooms. Discovery Park gained £2.75 million from the Government "Getting Building Fund" as part of a £6 million capital project, and CEO Mayer Schreiber has voiced support for further government investment in life sciences.

Faithful Global managed it.

Room for Faith managed it.

Click here for a Guardian article about the use of loopholes relating to places of worship.

HMRC gets very upset about this sort of thing - and sometimes catches up with the tax avoiders - but, unfortunately, it does not send them, or their legal advisors, to prison.

What a relief!

Small business tax relief means there are no Business Rates on a property with a rateable value of £12,000 or less - as long as it is the only property the business uses.

For properties with a rateable value of £12,001 to £15,000, the rate of relief will go down gradually from 100% to 0%.

The author visited a business that was in two small office units side by side. There were two entrance doors and each door had the name of a different company. Inside there were doors joining the two units on the ground and first floor.

A chat to the MD revealed that this was a tax fiddle. Each unit was small enough to avoid Business Rates but together they would have paid. So, a second company was formed (cost £50) and it became the tenant occupying the second unit - neither company paid Business Rates. Having two companies also enabled Corporation Tax to be minimised. For example, one held intellectual property, the other licenced it.

The sweet smell of a tax fiddle

When major companies (Debenhams, House of Fraser, GAP, Sports Direct etc.) closed down their shops in London’s Oxford Street, landlords lost tenants. So they granted “licences” for other shops to use the empty premises. A licence is often used for retail lets because they can be arranged quickly and for short terms without the negotiations required for longer formal leases.

Shops selling “American sweets” sprang up.

It turned out that many of them were being used for criminal activity including money laundering (which doesn’t normally worry the City of London two miles up the road) and selling counterfeit and illegal goods.

Westminster council found the shops were also not paying Business Rates so they attempted to chase them up. (It is the current “occupier”, usually a tenant, who pays Business Rates, not the freeholder). The companies running the shops turned out not to be real companies, or they simply vanished and the licence was taken on by another.

This mess is still being sorted out in 2025! One could argue that those granting the licences had failed to carry out due diligence - but why should they care - they got their money, probably as cash up-front!

Westminster’s problem would not exist under LVT and there would be no policing costs or hassle. The freeholder, whose details are known by the Land Registry, pays the LVT which is centrally collected by HMRC.

In the case of the sweet shops the landlord who granted the licences was probably someone holding a lease from the freeholder - 50% of Oxford Street is held by overseas investors, 20% by companies in Hong Kong.. LVT doesn’t care - the freeholder pays.

So, no exceptions for Land Value Tax

Various groups and various politicians have suggested that Land Value Tax can only be implemented if specific groups of people, or specific areas of land, are excluded.

This was tried in the early 1900s in England and in various countries overseas. It has always failed because the exceptions run riot, policing becomes impossible and the voting public loses faith.

Land Value Tax is either exactly as described on this site, with no exceptions or loopholes, or it will result in nothing but trouble for years to come. (Lawyers would ,of course, be very happy!)

LVT takes away all the hassle because:

LVT is paid by the freeholder - no need to chase “the occupier”.

LVT applies to the value of all land with no exceptions

LVT is centrally collected - freeing up LA resources for other things.

LVT can raise enough to match 100% of all LA expenditure.

LVT spreads the costs fairly across the country.

About lawyers

It isn’t fair that we keep blaming lawyers - it’s not their fault that legislation is so complex and so easy to ride a coach and horses through.

The problem comes with politicians who don’t see the consequences of every exception they add to new legislation.

One of us ran a company and had a rule: “if you can’t pitch your idea on one side of double spaced A4 then I am not interested.” Keep it simple, keep it short, allow no exceptions - and don’t confuse tax with spending - so, no tax breaks!

We personally know some really decent lawyers, nice people you would be happy to have round for dinner. On the other hand …